In the history of commerce, the method of exchange has moved progressively closer to the individual. We transitioned from physical commodities to paper notes, then to plastic cards, and finally to digital representations of those cards on our smartphones. However, each of these steps still required an external credential, something you have.

The Central Bank of the UAE (CBUAE) recently signaled the beginning of the final phase – Identity-as-a-Payment. By unveiling the region’s first biometric payment solution leveraging facial and palm recognition, the UAE is moving toward a future where the human body is the only credential needed.

This deep dive explores the technical under-the-hood mechanics of this shift, the security infrastructure provided by Network International and PopID, and why palm vein technology is the specific choice for a nation aiming for a 90% cashless economy by 2026.

How Palm Vein Technology Works

To understand why the CBUAE chose palm recognition alongside facial recognition, we need to examine the biological and technical differences between surface biometrics (fingerprints) and internal biometrics (palm veins). Here’s the basis on which the palm vein technology operates.

Near-Infrared (NIR) Imaging

Unlike a traditional camera that captures visible light reflected from the skin, a palm scanner uses Near-Infrared (NIR) light (typically around 760nm).

- Absorption: Deoxygenated hemoglobin in the blood flowing through your veins absorbs these infrared rays.

- Contrast: While the surrounding skin tissue reflects the light, the veins appear as a dark, complex network of lines to the sensor.

- The Blueprint: The sensor captures this internal map. Because veins are beneath the surface, they are not affected by external factors such as cuts, dirt, moisture, or even most skin diseases, which would render a fingerprint scanner useless.

Palm vs. Fingerprint

From a technical standpoint, a palm print contains approximately ten times more unique features than a single fingerprint. This provides an exponentially larger dataset for the algorithm to analyze, significantly reducing the False Acceptance Rate (FAR), the probability that the system incorrectly identifies a stranger as you.

The PopID & Network International Stack

The pilot at the Dubai Land Department isn’t just a hardware demo; it’s a masterclass in secure fintech integration. The solution is powered by PopID and enabled by Network International.

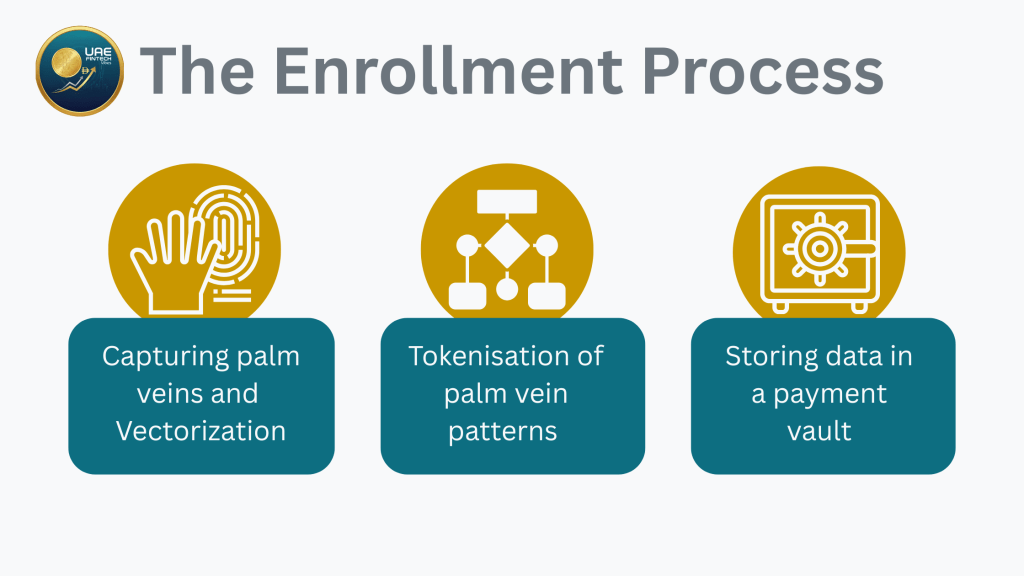

The Enrollment Loop

- Capture: The user performs a one-time registration where their face and palm are mapped.

- Vectorization: The system does not store a photo of your hand. Instead, it converts the vein patterns into a mathematical biometric template (a 1:1 vector).

- Tokenization: This template is encrypted and linked to a payment token (like a digitized version of your Visa or Mastercard).

- The Vault: The mapping between the biometric hash and the payment credential is stored in a secure, hardware-hardened environment, often utilizing Hardware Security Modules (HSMs) to prevent data leaks.

Why Palm Vein Technology is the Gold Standard for Security

As a fintech professional, you know that spoofing is the primary concern for any biometric system. Palm vein technology offers two distinct security advantages:

| Liveness Detection | Internal Privacy |

| Because the technology relies on the absorption of light by deoxygenated hemoglobin, it requires active blood flow. This means a high-resolution photo or even a prosthetic hand cannot trick the system. It only works with live tissue. | Unlike fingerprints, which we leave on every surface we touch (making them harvestable), your vein pattern is hidden. It cannot be photographed from a distance or lifted from a glass of water. This makes it inherently more private and difficult to replicate without the user’s consent. |

What is the UAE’s Digital Economy Agenda?

The CBUAE isn’t acting in a vacuum. This pilot is a cornerstone of the UAE Digital Economy Strategy, which aims to double the digital economy’s contribution to the non-oil GDP to 20% by 2031.

Frictionless Government Services

Starting the pilot at the Dubai Land Department is a strategic choice. High-value transactions, such as property registrations and fees, require the highest levels of Know Your Customer (KYC) and security. By proving the technology here, the UAE is establishing a bank-grade level of trust that can then trickle down to retail (cafes, malls) and transport (Dubai Metro).

Alignment with UAE Pass

Industry insiders anticipate that this biometric payment profile will eventually integrate with UAE Pass, the national digital identity. This would create a unified Global Identity for residents, with a single biometric enrollment covering government access, border crossings at e-gates, and daily commerce.

Biometric Payment – Challenges to Mass Adoption

Even with the CBUAE’s backing, a national rollout faces three primary hurdles:

- Hardware Infrastructure: Merchants must upgrade their Point-of-Sale (POS) terminals to include NIR sensors. While Network International is the largest acquirer in the region, this still requires a significant capital outlay.

- Psychological Barriers: Bio-phobia is real. Users may be hesitant to share biometric data for something as mundane as a cup of coffee. Transparency in how data is encrypted and stored will be the deciding factor for adoption.

- Cross-Border Interoperability: Will a Palm Profile created in Dubai work when the user travels to Riyadh or London? The standardization of biometric payment protocols (ISO/TC 68) will be essential for global utility.

What is Identity-as-a-Service (IDaaS)?

Looking ahead, we are moving toward a world of Identity-as-a-Service. In this model, the bank account is just a back-end utility, and the biometric is the front-end key.

As the UAE continues to lead the region, expect to see:

| Predictive Commerce | Invisible Checkouts |

| AI-linked biometrics that offer personalized loyalty rewards the moment you walk into a store, before you even pay. | Similar to Amazon Go, but utilizing the CBUAE’s unified national biometric standard to ensure security across all merchants, not just one brand. |

Bottom Line

The CBUAE’s biometric pilot at the Dubai Land Department is a clear signal – The wallet is becoming obsolete. By combining the security and hygiene of palm vein technology with the speed of facial recognition, the UAE is building the world’s most advanced payment infrastructure.

For fintech professionals and investors, the message is clear: the next big thing in payments isn’t a new card or a new app. It’s you.